This article was published by Insurance Business and is being shared here with thanks to the publication.

———

In an interview with Insurance Business last year, Danny Maleary CEO of Pro MGA Solutions underscored the need for the managing general agent (MGA) sector to take a “grown-up” approach to creating a healthy talent pipeline.

Cautioning against complacency in efforts to bridge the talent gap facing insurance, he championed taking a grow-your-own approach to talent, which leverages the expertise and insights of existing team-mates. It’s a model his own team have taken to heart, as seen by the appointment of Emily Lewis to a new role as business development representative at Pro MGA Solutions in January 2024.

Having joined Pro Global in 2020 as an assistant technician within insurance services, Lewis noted the importance of firms being willing to recognise the potential of their people and to mentor them to help them fulfil that potential. When you have a business that’s willing to make that investment and to guide you along that journey, it makes all the difference, she said, but also essential is you being able to seize that opportunity and make the most of it.

Emily Lewis and Danny Maleary pictured above.

What it takes to bring young talent into and through the market

“For me, bringing in people like Emily who were in a different part of the business into the sector and into our world is something we’re looking to do more of,” Maleary said. “It’s by mentoring, coaching and guiding young talent as to what we do as a business but also in terms of their personal aspirations and career path that we can really make a difference.

“It’s good to see so many young, passionate individuals who are part of our talent pipeline and part of the future of our business. And our investment in them will continue throughout the whole of our growth story, not just in the UK but also overseas.”

How is the MGA sector faring with regards to talent development?

From his vantage point of observing the market, Maleary said it has become clear to him that certain areas of the MGA sector are underserved when it comes to embracing better diversity. It’s on the right path, he said, but the sector still has a lot more work to do. What is also clear is that it’s going to take a continuous programme of change and an ongoing commitment to nurturing and supporting a more diverse talent pipeline to move that dial.

“It has to start somewhere,” Lewis said. “And it really starts with having that physical representation where you see a team that is diverse and that has young people. Because that’s how you evidence progress.”

Is the wider insurance industry embracing talent initiatives?

The 2024 BIBA Conference was a great opportunity to speak with key stakeholders from all across the industry – from insurers, to reinsurers, to distributors – Maleary said, and it was interesting to see how conversations about talent are evolving. These businesses are really starting to build teams that are geared towards the future, he said, and are placing strong emphasis on empowering the next generation of talent.

“They’re putting the right focus on fostering and bringing along good quality individuals that just need that little bit of encouragement to help them develop a bit more confidence,” he said. “I’ve also seen that there are still some that sadly, haven’t done it yet. But there’s still time and generally speaking, I think where we are today is quite encouraging.”

Delivering the message of insurance to a broader talent base

Lewis highlighted that becoming part of the insurance has opened her eyes to the breadth of what the market does, but also to the range of opportunities an insurance career can offer. Before you join, she said, it’s easy to just think about insurance as being limited to cars and houses, but her experience in the sector has made her an advocate for spreading the word about the potential encased within an insurance career.

The next step now is for the market to embrace the opportunity to get out into the communities it serves and educate young people on the jobs that are available, she said. It’s something the industry hasn’t done enough of in the past and the time is right because more people are considering different career routes. Whether it’s graduate schemes or apprenticeships, or even support for travel expenses etc. there’s so much that insurance businesses can do to create greater access to insurance careers.

“It’s something I tend to kick around as an idea with my head of operations and people, how we can target people at the early end of their career,” Maleary said. “And we’ve nurtured individuals, we’ve taken on some internships. But I don’t think we do enough as a sector to get into schools early enough and have the right conversations with career advisors to really set out the stall of the insurance sector. Because there is still lots to be done and, as Emily said, it does have to start somewhere.”

Name: Danny Maleary

Job title: CEO, Pro MGA Global Solutions

To speak to the Pro Global team please feel free to reach out to us at:

To contact our PR team directly please use the link below

Data, often referred to as the oil of our sector, remains central to success. It’s the battleground where victories are won and lost. Initiatives like Lloyd’s Blueprint 2 underscore the pivotal role of data in market-wide transformation efforts. Whether structured or unstructured, mastering data manipulation is crucial for leveraging technologies like AI and forms of automation to benefit every facet of re/insurance.

The fusion of vast data potential with AI capabilities brings immense promise, but it also harbors risks, particularly concerning the potential for discrimination within models. Without adequate checks and balances, these biases could permeate decision-making processes. Thus, understanding the context of AI-generated insights is paramount. We must prioritise explainability and embed ethical considerations into model designs to ensure that the pursuit of advantage is aligned with ethical principles.

Looking ahead to the second half of the year, as technology hurtles forward, the question arises: Can we keep up? Are we instilling the right value structures into organisations and model designs to safeguard against unintended consequences? It’s essential to ensure that the evolving business of insurance remains true to the core values we aim to uphold. This alignment is the key to staying ahead in the rapidly evolving tech landscape.

With this in mind, I feel strongly that the next two to three years will be pivotal for our industry, marked by fresh momentum in the transformative potential of technology across the insurance value chain. With projections indicating robust growth, particularly in the US property and casualty (P&C) sector and the European managing general agent (MGA) sector, the stage is set for insurers worldwide to capitalise on opportunities while navigating through global challenges. At Pro Global, we stand at the forefront of this dynamic environment, witnessing firsthand the intersection of technological innovation and insurer operations.

The outlook for 2024 continues to be promising, with significant premium growth and easing inflation pressures forecast over the course of the year. Swiss Re predicts industry return on equity (ROE) at 9.5% in 2024 and 10.0% in 2025, supported by premium growth of 7.0% and 4.5% respectively in these years.

However, amidst this optimism, it’s crucial to acknowledge the diverse regional landscapes shaping the industry. 2024 sees ongoing multiple economic and geopolitical crises converging; and political shifts, with more than 80 countries – over half the world’s population – voting this year in elections that could be pivotal for global democracy. And, while the US P&C sector shows signs of strength, challenges such as hyperinflation in countries like Argentina and shifting regulatory pressures particularly with a focus on the applications of AI and automation in insurance, and ongoing scrutiny over governance, underscore the need for agility and adaptability across jurisdictions.

Challenges and Opportunities of Running Multinational Businesses

Running multinational insurance businesses entails navigating complex regulatory landscapes, addressing varying market demands, and optimising operational efficiencies across jurisdictions. In today’s interconnected world, insurers must deploy strategic solutions to capitalise on growth opportunities while mitigating risks associated with geopolitical uncertainties and regulatory changes. Against this backdrop, technology emerges as a critical enabler, offering solutions to streamline operations and enhance competitiveness, while maximising the value of their human expertise.

At Pro Global, we recognise the transformative power of technology in reshaping insurer operations. Our international team of insurance experts, spanning across the UK, Europe, Latin America, and the US, collaborates seamlessly to deliver value-added services to our clients worldwide. From this perspective, we can see that from claims management to underwriting – automation solutions are revolutionising every aspect of the insurance value chain.

Last year’s acquisition of Propel Automation underscores our commitment to delivering value through cutting-edge technology, empowering insurers to drive operational efficiencies and capitalise on growth opportunities, and throughout 2024 we have been embedding digital services across our business verticals to augment and enhance our support for leading re/insurers.

Ethics and Automation: a headline topic for 2024

As I alluded to at the start, a key part of this conversation is the ethical considerations of weaving automation into the corporate fabric of re/insurance. While technology offers unprecedented opportunities for efficiency and innovation, it is imperative that insurers maintain a human-centric approach and prioritise ethical practices.

Moreover, as insurers increasingly rely on data-driven algorithms for pricing and risk assessment, ethical oversight is paramount. It is essential to ensure that these algorithms are transparent, fair, and free from bias, particularly when sensitive data such as health or personal information is involved. Our sector has a regulatory and ethical duty to uphold trust, integrity, and fairness in the way re/insurance operates, ultimately benefiting both customers and society at large.

A key focus for 2024 and 2025 is striking the balance between automation and human expertise. Rather than replacing humans, automation should complement and enhance the capabilities of insurance professionals, enabling them to focus on high-value tasks that require empathy, creativity, and critical thinking.

At the same time, the significant introduction of technology that both streamlines and augments the tasks that are completed by human beings introduces a critical new point of potential operational failure. It is therefore essential that insurers recognise this potential failure point, and proactively work to address eventualities, to assure business continuity and resilience in all contexts. This control-focused and anticipatory thinking applies not only during digital transformation programmes, but also with post transformation operations, which need as much focus on measurement and continuous improvement as the technology opportunity that is being harnessed. It is vital that insurers avoid inadvertently automating flaws into their core operations and processes that could, if left unchecked, snowball into significant operational challenges.

While embracing innovation with this critical thinking in mind, insurers must also contend with legacy systems that pose challenges to modernisation efforts. Legacy technology, particularly in run-off and legacy portfolios, can impede operational efficiency and inhibit the adoption of new technologies.

However, it’s essential to recognise that legacy systems play a vital role in supporting core business functions and must be integrated effectively with newer technologies. We advocate for a balanced approach to legacy tech, leveraging modernisation strategies to enhance operational efficiencies while ensuring seamless integration with existing systems. By adopting a phased approach to technology transformation, insurers can unlock the full potential of the data within their legacy systems while embracing the benefits of new technologies.

The Rise of MGAs and Tech-Centric Startups

At the same time that traditional insurers are evolving, the MGA sector continues to serve as a hotbed of innovation, bridging the gap between traditional insurers and emerging technologies. Pro Global’s subsidiary, Pro MGA Global Solutions, stands as a testament to this trend, with tech at the heart of every startup’s proposition.

The agility and flexibility inherent in the MGA model allow capacity providers to access startups to experiment with new technologies and underwriting approaches, driving innovation and differentiation in the marketplace. Pro MGA Global Solution’s multi-territorial platform supports the incubation of new MGA startups, enabling them to scale rapidly and capture market opportunities efficiently. In 2024, we anticipate continued growth and expansion in the MGA sector as insurers seek innovative solutions to meet evolving customer needs.

With the increasing emphasis on efficiency and multi-territory access, brokers are also increasingly seeking collaboration opportunities with entities like Pro MGA Global Solutions to develop more efficient models for distributing and placing business into global markets. Parametric insurance and tracker-type syndicates represent just a few examples of how the insurance industry is aligning with wider financial services in terms of data-driven progress.

Expertise and Tech Combined as Core Enablers of Growth

I am firmly of the view that technology working in harmony with sector-specific expertise will remain the cornerstone of insurer success. From harnessing AI for risk insight to streamlining processes through automation, re/insurers, brokers and MGAs have unprecedented opportunities to drive growth and profitability, through the focused lens of human expertise.

Pro’s competencies lie in its unique blend of proprietary technology and market practitioner insights, which form the backbone of its service offering. Unlike traditional tech companies, our technology is not developed in isolation but is intricately crafted through the lens of Pro’s own market practitioners. This ensures that our solutions directly address real challenges encountered in the field, honed through repeated encounters over time.

Pro stands out as both an enabler and a partner. Our approach bridges the gap between the old and the new, leveraging the expertise of practitioners alongside cutting-edge technology, both proprietary and partnered. Moreover, our partnerships extend to solutions developed by market practitioners for market practitioners, enhancing the relevance and applicability of our offerings.

The differentiation we offer is not merely in transformation but also in our thoughtful consideration of the post-transformed operating state. We focus on the thematic of automation and the evolution of capabilities and controls beyond the initial transformation phase. This holistic approach ensures that our solutions not only bring about change but also pave the way for sustained innovation and efficiency.

We recognise the interconnected nature of global challenges, and the need to reject old silos in favor of collaborative, innovative approaches. As the CEO of Pro Global, I am confident that together, we can navigate through the complexities of the insurance landscape and emerge stronger, more agile, and better prepared to thrive in the evolving global marketplace.

Name: Steve Lewis

Job title: CEO

To speak to the Pro Global team please feel free to reach out to us at:

To contact our PR team directly please use the link below

Key to this challenge lies the post-audit phase. It’s not merely about ticking boxes or meeting regulatory requirements; it’s about instilling a culture of continuous improvement and forging longer-term partnerships that transcend the audit cycle. This is where the significance of post audit consultancy emerges as a partnership approach providing support for MGAs and TPAs striving to achieve and maintain best practice in this rapidly growing side of the industry.

So, why is Post Audit Consultancy not just a value-add but a strategic necessity for MGAs and TPAs?

Extension of Audits and Professional Due Diligence

The audit lifecycle shouldn’t conclude with the delivery of a report; it should seamlessly transition into a phase of partnership aimed at improving observations and recommendations. Post Audit Consultancy extends this lifecycle, ensuring that audits aren’t just isolated events but part of a broader commitment to compliance best practice and operational excellence.

Guidance Tailored to Your Needs

Our consultancy team doesn’t just point out observations; we roll up our sleeves and work alongside MGAs and TPAs to address them comprehensively. Whether it’s underwriting, claims management, technical accounting, compliance, or SOX, our subject matter experts provide tailored guidance that’s rooted in deep industry knowledge.

Comprehensive Compliance Posture

With regulatory frameworks evolving constantly, maintaining compliance is an ongoing challenge. Post Audit Consultancy deepens your compliance posture by implementing expert guidance within your processes and procedures. This proactive approach ensures that your organisation not only meets regulatory standards but exceeds them.

Global Reach, Local Expertise

Our consultancy services aren’t bound by borders. With teams based in multiple locations and experienced in multiple languages, we offer unparalleled flexibility and adaptability. Wherever you operate, whatever your regulatory environment, our experts are ready to support you.

Protection of Reputation and Quality Standards

In an industry where reputation is paramount, Post Audit Consultancy provides peace of mind. By ensuring that observations are corrected promptly and compliance posture is continually enhanced, MGAs and TPAs can safeguard their reputation, brand, and quality standards.

In the fast-paced world of MGAs and TPAs, the only constant is change. With Post Audit Consultancy, we are working with leading MGAs and TPAs to help them embrace change as an opportunity for growth and innovation, confident in the knowledge that they have a trusted partner by your side, every step of the way.

Name: Robert Sherman

Job title: US Head of Audit & Advisory

To speak to the Pro Global team please feel free to reach out to us at:

To contact our PR team directly please use the link below

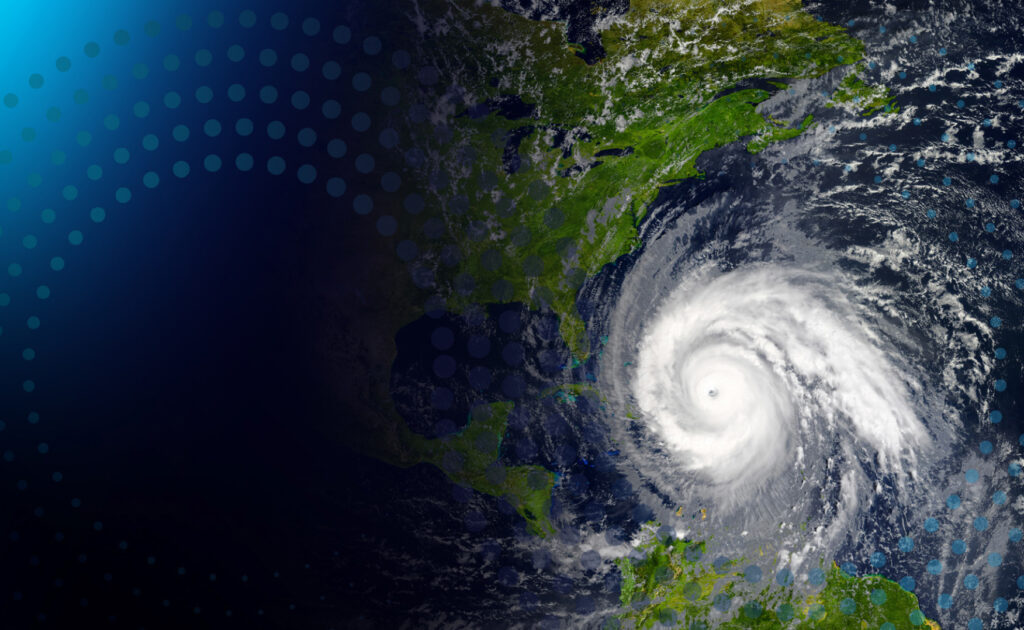

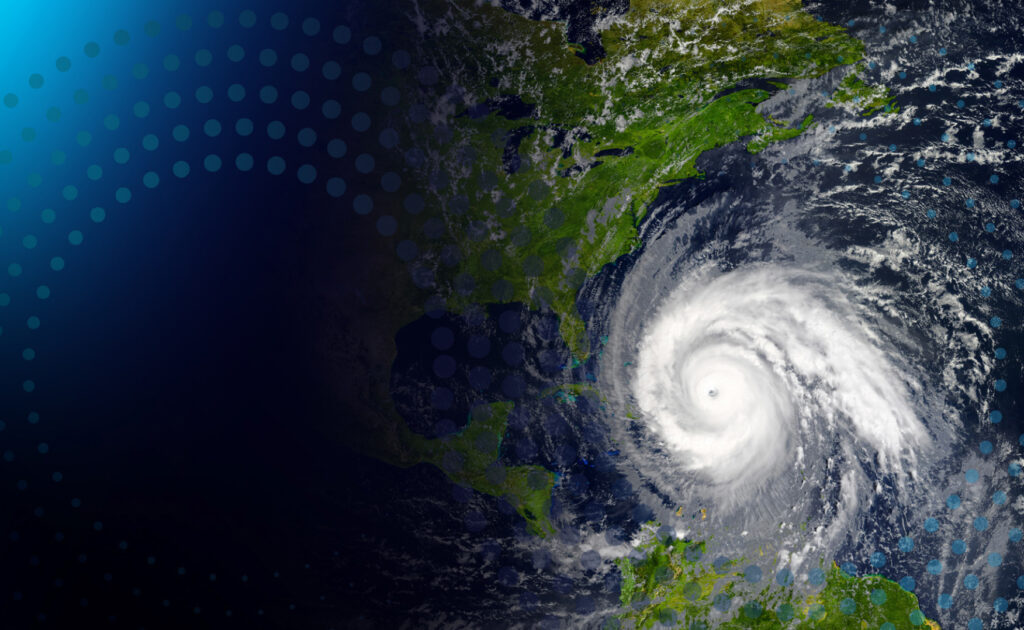

Con temperaturas de la superficie de los océanos en niveles récord y un debilitamiento de El Niño que reduce la velocidad del viento, el escenario se estaría preparando para tormentas potencialmente devastadoras. En esos momentos, la eficiencia en el procesamiento de siniestros, se vuelven primordial para brindar un excelente servicio a los asegurados afectados.

Las pérdidas aseguradas mundiales por catástrofes naturales en 2023, superaron los US$ 100.000 millones por cuarto año consecutivo, según Swiss Re. El citado Reasegurador, también indicó que el principal factor de las pérdidas de US$ 108 mil millones del año pasado, fue la frecuencia de los eventos, mientras que las tormentas convectivas severas (SCS), representaron un récord de US$ 64 mil millones de pérdidas durante el año.

La temporada de huracanes del Atlántico Norte, comienza oficialmente el 1 de junio de 2024 y finaliza el 30 de noviembre de 2024.

A continuación, detallamos tres consejos claves para ayudar a las aseguradoras a prepararse ahora y evitar retrasos en la gestión de los siniestros:

En primer lugar, las aseguradoras necesitarán delinear un plan de adecuación de recursos humanos y tecnológicos para poder afrontar el incremento estacional de los siniestros. Poner a los asegurados en primer plano, significa garantizar un pago rápido, eficiente y justo de las reclamaciones una vez ocurrida una catástrofe natural. Las preguntas que cada aseguradora debe hacerle a su equipo operativo incluyen:

El procesamiento eficiente de siniestros catastróficos, depende de flujos de trabajo optimizados y de una colaboración eficaz, especialmente con las Reaseguradoras. Es crucial contar con los protocolos de gestión de siniestros y aprobación de pagos correctos para garantizar el rápido pago de montos significantes. Además, es imperativo anticipar y prepararse para los reclamos de Business Interruption que también impactarán a corto y mediano plazo, posteriores al evento catastrófico.

En Pro Global, nuestro equipo cuenta con una amplia experiencia en brindar soporte a las Aseguradoras y Reaseguradoras durante los aumentos repentinos de reclamaciones, tal como sucedió luego de los huracanes Irma y María en 2017. Entendemos la importancia crítica de la precisión y la eficiencia en el proceso de ajuste de pérdidas y manejo de siniestros. Al identificar los desafíos comunes que enfrentan nuestros clientes, desarrollamos las mejores soluciones alineadas con las demandas de huracanes y otros eventos catastróficos.

No espere a que llegue la tormenta; actúe ahora para organizar sus recursos humanos y tecnológicos. Ponerse en contacto con expertos en reclamaciones como los de Pro Global, puede ayudar a las Aseguradoras y Reaseguradoras a prepararse de forma pro-activa para los desafíos que se avecinan. Al aprovechar nuestra experiencia y soluciones personalizadas, las Aseguradoras y Reaseguradoras, pueden afrontar con confianza las complejidades de una potencial temporada de huracanes superior al promedio.

La prestación eficiente de servicios de siniestros durante un aumento de reclamaciones por eventos catastróficos, puede mejorar o empeorar la reputación de una Aseguradora. La planificación proactiva, los procesos optimizados y el apoyo de expertos son esenciales. Al priorizar las necesidades de los asegurados, optimizar los flujos de trabajo y aprovechar la experiencia de la industria, las aseguradoras y reaseguradoras podrán confiar en que están preparadas para cumplir su compromiso con los clientes en tiempos de crisis, cuando se demuestra el valor de estar asegurado.

Name: Guillermo Ogan

Job title: Claims Manager (LatAm)

To speak to the Pro Global team please feel free to reach out to us at:

To contact our PR team directly please use the link below

Global insured natural-catastrophe losses in 2023 surpassed $100bn for the fourth year in a row, according to Swiss Re. The carrier said the main driver of last year’s $108bn in losses was the frequency of events, with severe convective storms (SCS) accounting for a record $64bn in losses during the year.

The North Atlantic Hurricane season officially begins on June 1, 2024, and ends on November 30, 2024.

Here are three key tips to help insurers prepare now, to prevent claims delays when it matters most for policyholders.

1. Plan for Surge Resources

First and foremost, insurers need robust surge resource plans tailored to handle the expected influx of claims. Putting policyholders front and center means ensuring fast, efficient, and fair payment of claims as soon as possible after a catastrophe strikes. Questions to ask your operational team include:

2. Streamline Claims Processing

Efficient claims processing hinges on streamlined workflows and effective collaboration, especially with reinsurers. It’s crucial to have the correct approval protocols in place to ensure smooth authorisation and payment of large catastrophe claims. Moreover, anticipating and preparing for business interruption and related liability claims in the medium-term aftermath of a storm is imperative.

3. Leverage Expertise and Experience

At Pro Global, our team boasts extensive experience in supporting insurance businesses during surges in claims, including the aftermath of Hurricanes Irma and Maria in 2017. We understand the criticality of accuracy and efficiency in the loss adjusting and claims handling process. By identifying common challenges faced by our clients, we develop best-in-class solutions aligned with the demands of catastrophic hurricanes.

4. Act Now

Don’t wait for the storm to hit—act now to put resources in place. Getting in touch with claims experts like those at Pro Global can help insurers proactively prepare for the challenges ahead. By leveraging our expertise and tailored solutions, insurers can navigate the complexities of an above-average hurricane season with confidence.

Efficient claims servicing during a surge in catastrophe claims can make or break an insurer’s reputation. Proactive planning, streamlined processes, and expert support are essential. By prioritising policyholder needs, optimising workflows, and leveraging industry experience, insurers can ensure they are ready to fulfill their commitment to customers in times of crisis, where the promise of insurance matters most.

Get in touch with the claims experts at Pro Global today to fortify your claims servicing capabilities and prepare for the challenges ahead.

Name: Guillermo Ogan

Job title: Claims Manager (LatAm)

To speak to the Pro Global team please feel free to reach out to us at:

To contact our PR team directly please use the link below

Our U.S. Head of Audit & Advisory, Robert Sherman, recently attended the IRES Foundation 2024 National School on Market Regulation in San Diego, USA. Here are his three key takeaways from the event…

Insurers needs to be clear on their MGA relationships

To ensure market conduct is being met, it’s vital the relationship between the insurer and MGA is clear. When an insurance company gears up for review, it must be clear who does what, to understand the MGAs involvement in market conduct and responding to requests. The MGA must therefore be on notice when an exam is called.

It’s also important to ensure there is thorough and complete documentation, too. Too many companies don’t know who has access to what information or data. Getting ducks in a row will make a big difference when an MGA is then made aware there is a formal enquiry. There should be a contractual agreement between the two parties to gain access to carrier information. The carrier may be ‘outsourcing duties’ to the MGA, but the carrier remains responsible for the data and sharing with regulatory authorities when requested.

Third parties (MGAs, TPAs) are an extension of a carrier, who are responsible for their vendor

It’s important for carriers to take full responsibility when auditing, including adopting proactive auditing and reporting of issues.

Carriers may outsource or vend aspects of their business but, ultimately, the carrier is responsible for compliance. They must have a clear sight of what their vendors are doing, how data is maintained, and how such things as artificial intelligence (AI) may be utilized in diverse processes..

For example, if a carrier is vending out its claims, they must have the ability to access claims files, and must make sure they get information from administrators. Ultimately the carrier is the one that is licensed.

Carriers must also be proactive. When something is found, report it as soon as possible along with justification and explanation. It’s important to also consider controls that can be put in place to prevent this from happening in the future.

An uptick in self reporting will lead to an improved relationship with companies and regulators.

AI is evolving fast, as is the regulation around it. A degree of flexibility will need to be in place from insurers to ensure they can adapt when needed.

Regulators will want to know what AI processes are in place in the context of market conduct, and will want to understand what companies are doing – for example, understanding potential gaps. It is recommended that insurers sit with regulators and explain the processes they have in place, showcasing how the data is being used.

Insurers need to begin sooner than later to implement governance frameworks and be flexible as AI and its regulation develops. If there’s one word I would repeat to insurers, it would be Document; Document; Document!

Finally, insurers need to be able to explain their use in understandable terms. Cumbersome explanations or jargon just won’t cut it!

These insights from the IRES Foundation 2024 National School on Market Regulation event underscore the critical importance of clarity and responsibility within insurer-MGA relationships, as well as the necessity for thorough oversight of third-party vendors, and the imperative for insurers to adapt and remain flexible in the face of evolving AI technologies and regulations.

There are proactive steps that insurers can take to keep pace with these rapidly evolving dynamics, and ensure they are maintaining compliance best practice at all times. These include comprehensive documentation, proactive auditing, and transparent communication with regulators: a powerful trio that combined will market conduct and compliance practices. As the industry continues to navigate the complexities of market regulation, I hope these key takeaways from the evolving conversations in our market serve as helpful guidance for insurers striving to maintain integrity and effectiveness in their operations.

Get in touch to find out more about Pro Global’s Audit capabilities or talk to our team.

Name: Robert Sherman

Job title: US Head of Audit & Advisory

To speak to the Pro Global team please feel free to reach out to us at:

To contact our PR team directly please use the link below

El mercado asegurador local atraviesa un periodo complejo desde los puntos de vista técnico, económico y financiero, y esto pone a las compañías a redoblar esfuerzos para optimizar recursos. Una decisión de negocio inteligente en este contexto es buscar soluciones innovadoras que permitan reducir gastos fijos directos e indirectos. El ahorro es un concepto calve en estos tiempos.

En esa búsqueda, las aseguradoras están empezando a incursionar en la tercerización de procesos. Esta práctica es muy común en el mercado europeo y en Estados Unidos y hoy se está desplegando cada vez con más fuerza en América Latina. Está claro que la pandemia, al obligar a las empresas a desarrollar el trabajo a distancia, colaboró en el entendimiento de esta solución: la reconfiguración del negocio hacia la transformación digital dejó en evidencia que no es necesaria la presencialidad de los recursos humanos para la ejecución de algunas tareas. La tendencia de compañías livianas que tercerizan procesos clave es cada vez más palpable.

Y uno de los procesos clave del mercado asegurador que está entrando con éxito en esta dinámica es la gestión de siniestros. Las aseguradoras empiezan a entender y dimensionar los beneficios de tercerizar el abordaje administrativo de los siniestros. El desafío, en ese punto, es encontrar al partner indicado para hacerlo.

El socio estratégico especializado para este mandato es Pro Global. Como consultora, el sustento de nuestro expertise es el staff de recursos humanos experimentados en el manejo de carteras de siniestros y la tecnología aplicada al negocio.

Ofrecemos un servicio de excelencia de administración de siniestros de todas las ramas, con las variables de frecuencia e intensidad que presenten, de carteras “vivas” o de “run-offs”, para aseguradoras y reaseguradoras, en la Argentina y en Latinoamérica. Pro Global se adapta a las necesidades que tenga cada cliente: diseñamos el servicio a la medida, moldeando el abanico de posibilidades disponibles o desarrollando nuevas soluciones requeridas.

Pro Global puede abordar tareas específicas o bien todo el proceso de punta a punta (administración, gestión y negociación del siniestro) según se requiera. Los expertos de Pro Global, de forma remota, acceden al Sistema del cliente y le dan tratamiento al siniestro de la misma forma que se lo darían in-house, siguiendo los procesos de control y seguridad fijados por el cliente y respetando las estrategias de gestión definidas, alcanzando los ratios establecidos.

Los principales beneficios directos de la tercerización son la reducción de gastos fijos en recursos humanos y de las contingencias propias del trabajador (ausencias, licencias, vacaciones), y el ahorro en espacio físico e infraestructura in house. Además, queda resuelta la estacionalidad en materia de siniestros: cuando hay picos de casos por eventos masivos o por temporada, Pro Global absorbe la tarea liberando a la empresa de la necesidad de contratar más colaboradores. A esto se suma el relevante hecho de que las compañías pueden dejar en manos de especialistas estas tareas de administración y concentrar sus recursos en su core específico: hacer crecer su cartera de clientes con mayor foco en su negocio.

Por otra parte, el beneficio específico de tercerizar la gestión de siniestros en Pro Global, además, es un abordaje proactivo de cada siniestro que garantiza la aceleración del cierre de casos. Contamos con un sistema propio que logra procesos más eficientes y genera reportes diarios (métrica) de la gestión. Garantizamos los estándares más elevados de protección de datos y confidencialidad, ya que nuestros sistemas cumplen con todas las normas internacionales de Compliance y políticas de Data Protection.

Contamos, además, con los talentos específicos que requiere este abordaje, como abogados, técnicos en seguros, actuarios, contadores y administradores de empresas, entre otros profesionales. Nuestro equipo interdisciplinario da respuesta en todos los frentes del ciclo de vida de un siniestro y gestiona la relación con otros profesionales naturalmente involucrados, como peritos, abogados, médicos, entre otros.

Como consultora, nuestro principal diferencial es nuestra capacidad de innovar para dar respuesta a cada requerimiento. Invitamos a las aseguradoras y reaseguradoras a contactarnos para desarrollar en conjunto la solución a su medida en la gestión de siniestros.

Name: Guillermo Ogan

Job title: Claims Manager (LatAm)

To speak to the Pro Global team please feel free to reach out to us at:

To contact our PR team directly please use the link below

This article was published in Insurance Business Magazine and is being republished to Pro Global website with thanks.

The ‘turbo-rise’ of the market is reflected in the fact that 2023 saw a record 15+ MGAs incubated in Europe through Pro MGA, he said, and is forecasting double-digit opportunities and €100 million in premiums across its supported MGAs by year-end 2024. For Døhlen, the question now is how to support businesses looking to enter and grow in new territories. It’s a task he has ample experience in accomplishing having previously served as MD of an MGA and Lloyd’s Syndicate ably supported by Pro MGA Solution’s infrastructure and people.

“It was about five years ago that I came out of corporate insurance after 10 years with one of the global carriers,” Døhlen said. “At the time, I felt that innovation wasn’t really a core strength in a marketplace where there should be a lot more, as showcased by the insurance coverage gap and how insurers aren’t being seen by clients to be innovating in order to develop the products and solutions required to meet their coverage needs.”

The support of Danny Maleary [CEO of Pro MGA Solutions] and his team in helping him establish his MGA was his first introduction to the business, but what held his attention was their stated ambition to make MGAs a standpoint of innovation and market growth. When he was asked to help develop the business’s European expansion ambitions, he said, it was a rare case of “the stars aligning”.

Assessing the MGA market in Europe today, Døhlen noted the 20-plus set-ups carried out by Pro MGA were across different business classes, risk classes and sizes. The pipeline for this year is similarly strong, he said, and the firm is seeing high demand from individuals and organizations who are actively pursuing the MGA path.

There are a lot of factors at play behind this, he said, but key has been the changing attitude of risk carriers towards MGAs. These carriers no longer see MGAs as a threat to their market superiority but instead are embracing the opportunity to benefit from partnering with organisations with innovation and agility at the core of their mindsets.

“They are embracing more of a risk partnership model, which we’re seeing across the insurtech sector with how they’re evolving from ‘foe to friend’ by partnering and combining strengths instead of being in competition,” he said. “So, it’s all about being high-pace and having the ability to work with data and technology without being stopped by the legacy issues, which is a typical challenge amongst big insurers.

“It’s about them being able to dip their toes into new products and new markets and, in doing so, achieving growth. Something we’re seeing more insurers enjoying and embracing is the Lloyd’s coverholder model as well, which insurance companies are happy to support given that they know the framework.”

The change in approach has been “more of an evolution than a revolution” Døhlen said, because MGAs have worked to get themselves into shape as the clear go-to set-up for risk carriers. Brokers have also been instrumental in enabling that evolutionary shift by supporting MGAs, and affirming the value case of this business model.

He highlighted that some of the credit must also be given to clients because they have proven themselves prepared to purchase insurance from new and emerging companies, buoyed by their appetite for a rejuvenated value proposition that is more aligned with their specific needs and interests. It’s a very rewarding time to be in the market, he said, because with innovation now front of mind, MGAs have a very clear role to play– and he’s positive this will continue in the coming years.

The future is especially bright in Europe, he said, where, largely speaking, it’s relatively easy to set up an MGA and the path to doing so is increasingly well-trodden. Insurance companies giving the MGA model their stamp of approval is leading to increased instances of insurers partnering with MGAs which, in turn, is encouraging more brokers and clients to step away from traditional placement models.

How MGAs continue to utilise data and technology remains a key driver of the success of the model, he said, and it’s when all these factors come together that you have a really strong platform on which MGAs can thrive.

To speak to the Pro Global team please feel free to reach out to us at:

Name: Hans Martin Døhlen

Job title: Managing Director, Pro MGA Solutions Europe GmbH

To contact our PR team directly please use the link below

With reputations, brands, and quality standards under scrutiny, there’s a pressing need for robust internal audit functions to provide steadfast support and reassurance to insurers that they are maintaining their standards across business functions, and focused on continuous improvements.

Internal Audit Services are strategically imperative for insurers. Regulators and market bodies demand assurance that carriers are upholding their promises, safeguarding their reputation, and adhering to stringent quality standards. This necessitates a thorough evaluation of internal processes, controls, and compliance measures.

Strengthened internal audit functions serve as the frontline defense, instilling confidence by providing independent assurance that risk management, governance, and internal control processes are operating effectively.

Internal audits play a pivotal role in objectively enhancing an organization’s business practices. By scrutinizing culture, policies, and procedures, internal auditors contribute to the oversight of the board and management. They verify the effectiveness of internal controls, assess operational efficiency, mitigate risks, and ensure compliance with laws and regulations. This kind of objective insight can be critical to shaping the future tactics and strategies for an insurer.

However, to reap the full benefits of internal audit services, credibility and expertise are paramount. Pro Global’s team of proven experts stands ready to augment existing staff or provide invaluable third-party insight. Our experienced insurance auditors can provide an independent and unbiased view, adding value to the organization by identifying areas for improvement without operational bias. Whether it’s enhancing current processes or offering a fresh perspective through due diligence and quality assurance, Pro’s Internal Audit Services are tailored to elevate your organization’s performance and compliance standards.

Augment your internal audit team with Pro’s experts or allow Pro to perform a Due Diligence review of your current internal audit program. Get in touch to learn more about how our Internal Audit Services can fortify your business and ensure its sustained success.

Name: Robert Sherman

Job title: US Head of Audit & Advisory

To speak to the Pro Global team please feel free to reach out to us at:

To contact our PR team directly please use the link below

At the same time, the traditional methods of evaluating agency performance are evolving. Beyond mere adherence to contractual and underwriting provisions, there is a growing demand for deeper insight into how individual agencies impact overall performance and loss ratios. This necessitates a shift towards tailored audit solutions that address the unique needs of each client.

Recognizing this emerging trend, Pro Global has developed a cutting-edge Agency Management Review service tailored specifically for the US market. This innovative offering leverages our partnerships with actuarial staff to provide unparalleled insights into the performance of agency partners.

One of the key pillars of our Agency Management Review service is ensuring compliance with underwriting standards. By meticulously evaluating adherence to contractual obligations and underwriting guidelines, we help safeguard the reputation, brand, and quality standards of our clients. This not only instills confidence in stakeholders but also mitigates potential risks associated with non-compliance.

Moreover, our approach goes beyond compliance by identifying specific areas that may be affecting agency performance. Whether it’s poor loss ratios or operational inefficiencies, our team of experts conducts a thorough analysis to pinpoint areas for improvement. Armed with this actionable intelligence, our clients can make informed decisions to optimize agency performance and enhance overall profitability.

At the heart of this new service is our commitment to delivering accurate and actionable audit result reports. We understand that generic, one-size-fits-all solutions fall short in today’s complex insurance landscape. That’s why our Agency Management Review service is tailored to meet the specific needs and objectives of each client. Whether it’s a comprehensive assessment of agency operations or a targeted review of underwriting practices, our reports provide invaluable insights that drive tangible results.

By partnering with Pro Global for Agency Management Review, insurers and MGAs can enjoy a myriad of benefits. Firstly, they gain the confidence that their reputation, brand, and quality standards are being protected by a team of seasoned professionals. Secondly, our accurate audit result reports serve as a roadmap for enhancing agency performance and driving sustainable growth.

As the US P&C insurance market looks set for substantial growth in the coming years, the importance of effective agency portfolio management cannot be overstated. Insurers and MGAs must proactively monitor and optimize the performance of their agency partners to capitalize on emerging opportunities and mitigate potential risks.

Pro Global has responded quickly to market demand by developing an expert new Management Review service, designed to support clients in knowing that their agency partners are meeting underwriting standards and driving sustainable growth in-line with the robust growth forecast expected for the market as a whole in the coming years.

Name: Robert Sherman

Job title: US Head of Audit & Advisory

To speak to the Pro Global team please feel free to reach out to us at:

To contact our PR team directly please use the link below