The shift is being driven by a combination of regulatory pressure, operational inefficiencies, and the increasing complexity of global insurance operations. But rather than pursuing flashy, all-encompassing transformation projects, many firms are opting for focused automation efforts that deliver tangible value in short timelines.

Take, for example, an international specialty insurer recently facing the challenge of achieving full Sarbanes-Oxley (SOX) compliance across four distinct US-based entities. Each business had a different level of maturity in terms of documentation and internal controls, making a one-size-fits-all approach impossible. Rather than throw resources at the problem, the insurer implemented a lean, strategically phased automation and audit readiness programme.

By combining mock audits, structured interviews, and risk assessments, the firm identified high-risk areas and embedded automation to support financial reporting and access management controls. A rapid readiness assessment was completed in just two weeks, and full SOX compliance was achieved within 18 months – significantly ahead of industry norms. Just as important, the programme delivered sustainable improvements, including automation tools to monitor compliance over time, improved documentation, and upskilled internal teams.

This is a clear example of automation supporting compliance, but the same principles are also being applied to operational areas like finance and claims reconciliation.

Another organisation, a fast-growing global risk exchange, recently automated a previously manual journal creation process tied to its virtual payments network. As the company expanded across the UK, Europe, and North America, its finance team faced a daunting weekly task: manually extracting data, transforming it into journal entries, and uploading it to their accounting system. It took multiple subject matter experts several hours each week, a bottleneck that couldn’t scale with the business.

Automation changed the game. By integrating directly with the payments platform’s API and deploying a robotic process automation (RPA) bot, the company eliminated manual extraction and transformation entirely. The process now runs automatically before the start of business, validating data and emailing results to finance staff for sign-off.

The result? A 45% reduction in processing time and a complete reallocation of full-time employee (FTE) hours to higher-value tasks. Moreover, automation reduced the risk of manual errors and strengthened data security, a growing concern in a digital-first operating environment.

What both examples show is that successful automation programmes share several key characteristics: they are pragmatic, not flashy; they deliver measurable savings, not just potential; and they are deeply embedded into the existing technology stack, rather than attempting wholesale system replacement.

Integration remains one of the biggest challenges. Many insurers still operate a patchwork of legacy systems, each with its own data standards and interfaces. Rather than rip and replace, leading firms are using APIs and middleware to build automation capabilities that complement, rather than compete with, legacy infrastructure.

For example, in both the compliance and finance cases above, automation was layered onto existing platforms. This approach enabled quick wins, avoided disruption, and provided a stepping stone for broader digital transformation initiatives.

Looking ahead, automation in insurance isn’t just about innovation for the sake of it – it’s a practical response to rising demands for efficiency, risk reduction, and sustainable growth. While technologies like RPA, low-code tools, and AI validation are becoming the norm, the real transformation is cultural. Automation is now a shared capability spanning operations, finance, compliance, and more; breaking down silos, connecting functions, and enabling re/insurers to scale, adapt, and thrive with greater agility than ever before.

Name: Kristy Lovegrove

Job title: Group Head of Technology and Digital Services

To speak to the Pro Global team please feel free to reach out to us at:

To contact our PR team directly please use the link below

Walking through the Pro Global doors just a few months ago, our new Head of Client Engagement at Pro Germany, Roman Hannig, has got his feet firmly under the table.

An experienced lawyer and complex claims specialist, Roman joined Pro Global Germany from Gen Re Corp. His role is to support and expand Pro’s leading (re)insurance clients’ relationships across Germany with the management of complex employee disability claims. Boasting extensive experience in client relations of premium insurers and a deep understanding of market dynamics, Roman was the perfect fit for Pro Germany.

In this latest Meet the Pros blog, we learn more about Roman’s background and market intel.

I am a fully qualified lawyer and have been working in the insurance industry for over 20 years. During my time as an independent lawyer, direct client contact was always at the forefront of my work – my law firm mainly handled corporate clients. In 2011, I joined General Re Insurance AG. As a claims executive, I focused on complex biometric claims and supporting German primary insurers. Close interaction with the market was a key priority for me. Through regular visits, events and workshops, I was able to build long-standing relationships based on trust.

My current role at Pro Global ties in seamlessly with this experience – the move from reinsurer to leading service provider for biometric claims verification was an exciting change of perspective for me. I find working with a dynamic, interdisciplinary team particularly appealing.

No two days are the same. I regularly visit our clients – most recently in Hamburg together with our Head of Claims. Even in an increasingly digital world, direct and personal interaction is still very important to me.

In addition to numerous online meetings, which are managed operationally and which I support, I take the opportunity to get to know our clients better.

The aim is always to continuously improve our services and the underlying processes.

Another focus is on internal cooperation – whether in relation to customer issues, marketing activities, IT innovations or new product ideas. In addition, I deal with data protection issues and take on classic legal tasks such as drafting and coordinating contracts.

Our top priority is to provide our clients with long-term support at the highest professional level.

That is why I am actively involved in training and provide selective support in day-to-day operations, particularly in complex claims cases. My contribution is intended to further strengthen quality and efficiency in order to sustainably expand our expertise and effectiveness in the German market.

We continue to see steady growth in biometric products, although I believe the market is increasingly consolidating and is dominated by the major players.

There is a lot of movement, particularly in the area of product development: basic insurance, sick leave modules, updated terms and conditions, and long-term care and dread disease insurance are becoming noticeably more important. Overall, there is a trend towards greater personalisation, i.e. tailor-made insurance rates that take greater account of the individual risk behaviour of customers.

In addition, digitalisation has gained momentum, both in terms of risk assessment and claims assessment. Although there are still differences between companies at present, these are likely to become increasingly uniform in the future.

This is also changing sales and consulting, where personal contact is increasingly being supplemented by digital processes.

The insurance industry is currently facing a number of challenges. In addition to ever-increasing data protection and regulatory requirements, there is a growing need to make internal processes more efficient while ensuring transparency and modern, digital communication with customers. At the same time, the integration of digital technologies and artificial intelligence into operational processes is advancing – a development that requires not only technical expertise but also broad acceptance among the workforce.

In addition, there are already noticeable staff shortages in some claims departments, which are likely to become even more acute as the baby boomer generation enters retirement. At the same time, the world of work is undergoing fundamental change: the willingness and opportunity to change employers has increased, which is increasingly calling into question the previously often close and long-standing employee loyalty.

On the customer side, I see a thoroughly positive perception: thanks to modern digital solutions, customers benefit from faster and more transparent review processes and optimised communication via both digital and traditional channels. The range of services is supplemented by services such as digital application processes.

In addition, continuous product enhancements and a growing product diversity already enable individually tailored coverage of existential risks.

Greater transparency ultimately leads to greater trust.

At Pro, we see ourselves as an active partner on an equal footing, accompanying and helping to shape the transformation of the industry. As a leading provider of biometric risk processing in Germany, we have a team of 35 highly qualified claims adjusters with extensive experience and expertise. This enables us to support primary insurers flexibly and in line with their needs – whether through comprehensive claims processing or targeted medical and legal assessments. We offer complete outsourcing solutions for companies with low claims volumes, while our qualified staff can step in at short notice to provide temporary support.

In addition, we advise insurers on strategic and operational matters relating to the optimisation of their specialist processes, the improvement of claims handling quality and the introduction of technical support. We develop our own AI tools and digital systems, which we currently use internally but will also make available to the market in the future.

I see a number of overarching issues that we as an industry need to address. These include, above all, the need to create attractive and flexible working models and to invest specifically in the training and development of our employees – always in conjunction with an open attitude towards new technologies.

It is crucial to involve the workforce in change processes at an early stage and to sensitively address and dispel any reservations about new systems. Despite all the momentum towards digitalisation, we must not lose sight of the human aspect. Customer focus, personal availability and transparent review processes remain key success factors for me.

At the same time, we are facing new challenges in claims assessment – for example, due to rising numbers of claims, but also new products and product variants.

Field service is a personal concern of mine – an area in which I myself worked for many years and whose added value I still consider highly relevant, especially in more complex claims cases. In my view, the demand for efficiency must not lead to personal contact becoming less important.

As a partner on equal terms, we bring steadily growing expertise and a broad service portfolio to our collaboration with insurers. I hope that this article will be seen as an opportunity to work together to ensure quality and flexibility in claims processing in the long term.

To speak to the Pro Global team please feel free to reach out to us at:

Name: Roman Hannig

Job title: Head of Client Engagement

To contact our PR team directly please use the link below

Obwohl erst seit etwas mehr als zwei Monaten an Bord, hat sich unser neuer Head of Client Engagement, Roman Hannig, bereits bestens eingelebt.

Mit seiner juristischen Expertise und einem besonderen Fokus auf komplexe biometrische Schadenfälle bringt er wertvolle Branchenerfahrung mit. Zuvor war er bei der General Reinsurance AG tätig – nun verstärkt er das Team von Pro Global mit klarem Blick auf exzellente Kundenbeziehungen.

In seiner Rolle treibt Roman den Ausbau unserer Partnerschaften mit führenden Versicherern voran. Sein Anspruch: nachhaltige, vertrauensvolle Zusammenarbeit etablieren, unsere Servicequalität weiterentwickeln und neue Lösungsansätze gemeinsam mit unseren Kunden gestalten.

Ob bei der Begleitung besonders anspruchsvoller Schadenfälle oder der internen Wissensweitergabe, aufgrund seines Weitblicks, Engagements und Branchen-Know-hows ist er die ideale Besetzung für uns.

Ich bin Volljurist und seit über 20 Jahren in der Versicherungswirtschaft tätig. In meiner Zeit als selbstständiger Rechtsanwalt stand der direkte Kundenkontakt stets im Mittelpunkt – meine Kanzlei betreute hauptsächlich Unternehmensmandate. Ab 2011 war ich für die General Re Insurance AG tätig. Als Claims Executive lag mein Fokus auf komplexen biometrischen Schadenfällen sowie der Betreuung deutscher Erstversicherer. Dabei war mir der enge Austausch mit dem Markt ein zentrales Anliegen. Durch regelmäßige Besuche, Veranstaltungen und Workshops gelang es, langjährige und vertrauensvolle Beziehungen aufzubauen.

Meine aktuelle Rolle bei der Pro Global knüpft nahtlos an diese Erfahrungen an – der Übergang vom Rückversicherer zum führenden Dienstleister für biometrische Leistungsprüfung war für mich ein spannender Perspektivwechsel. Besonders reizvoll finde ich die Zusammenarbeit mit einem dynamischen, interdisziplinären Team.

Kein Tag gleicht dem anderen. Regelmäßig bin ich bei unseren Kunden vor Ort – zuletzt etwa in Hamburg gemeinsam mit unserem Head of Claims. Auch in einer zunehmend digitalen Welt ist für mich der direkte und persönliche Austausch von zentraler Bedeutung.

Neben zahlreichen Online-Meetings, die operativ geleitet werden und bei denen ich zur Seite stehe, nutze ich die Gelegenheit, unsere Auftraggeber besser zu verstehen. Ziel ist es stets, unsere Dienstleistungen und die zugrunde liegenden Prozesse kontinuierlich zu verbessern.

Ein weiterer Schwerpunkt liegt auf der internen Zusammenarbeit – sei es in Bezug auf Kundenthemen, Marketingaktivitäten, IT-Innovationen oder neue Produktideen. Darüber hinaus betreue ich datenschutzrechtliche Fragestellungen und übernehme klassische juristische Aufgaben wie das Erstellen und Abstimmen von Verträgen.

Unsere oberste Prämisse: Unsere Kunden langfristig auf höchstem fachlichem Niveau begleiten.

Deshalb engagiere ich mich aktiv in Schulungen und unterstütze punktuell das operative Tagesgeschäft, insbesondere bei komplexen Leistungsfällen. Mein Beitrag soll dazu dienen, Qualität und Effizienz weiter zu stärken – um unsere Kompetenz und Schlagkraft im deutschen Markt nachhaltig auszubauen.

Wir beobachten weiterhin ein kontinuierliches Wachstum bei biometrischen Produkten, wobei sich der Markt aus meiner Sicht zunehmend konsolidiert und vor allem durch die großen Player geprägt ist.

Besonders im Bereich der Produktentwicklung zeigt sich viel Bewegung: Grundfähigkeitsversicherungen, AU-Bausteine, aktualisierte Bedingungswerke sowie Pflege- und Dread-Disease-Versicherungen gewinnen spürbar an Bedeutung. Insgesamt besteht der Trend zu mehr Personalisierung, also maßgeschneiderten Versicherungstarifen, die das individuelle Risikoverhalten der Kundschaft stärker berücksichtigen.

Zudem hat die Digitalisierung immer mehr an Fahrt aufgenommen, sei es mit Blick auf die Risiko- als auch die Leistungsprüfung. Zwar gibt es derzeit noch Unterschiede zwischen den Gesellschaften, perspektivisch werden diese sich zunehmend angleichen.

Damit ändern sich auch Vertrieb und Beratung, wo der persönliche Kontakt immer mehr durch digitale Prozesse ergänzt wird.

Die Versicherungsbranche steht derzeit vor einigen Herausforderungen. Neben den stetig steigenden datenschutzrechtlichen und regulatorischen Anforderungen rückt die Notwendigkeit in den Fokus, interne Prozesse effizienter zu gestalten und dabei gleichzeitig Transparenz sowie eine moderne, digitale Kommunikation mit den Kunden sicherzustellen. Parallel dazu schreitet die Integration digitaler Technologien und Künstlicher Intelligenz in die operativen Abläufe voran – eine Entwicklung, die nicht nur technisches Know-how, sondern auch eine breite Akzeptanz innerhalb der Belegschaft verlangt.

Dazu kommen bereits spürbare personelle Engpässe in einigen Schadenabteilungen, die sich mit dem Eintritt der Babyboomer-Generation in den Ruhestand weiter verschärfen dürften. Gleichzeitig verändert sich die Arbeitswelt fundamental: Die Bereitschaft und Möglichkeit zum Arbeitgeberwechsel ist gestiegen, was die bislang oft enge und langjährige Mitarbeiterbindung zunehmend infrage stellt.

Auf Kundenseite sehe ich eine durchaus positive Wahrnehmung: Dank moderner digitaler Lösungen profitieren Kundinnen und Kunden von schnelleren und transparenteren Prüfungsprozessen sowie von einer optimierten Kommunikation über digitale wie auch traditionelle Kanäle. Ergänzt wird das Leistungsspektrum u.a. durch Services wie digitale Antragsstrecken.

Zudem ermöglichen kontinuierliche Produktweiterentwicklungen und eine wachsende Produktvielfalt bereits heute eine individuell zugeschnittene Absicherung existenzieller Risiken. Durch mehr Transparenz wird letztlich auch mehr Vertrauen aufgebaut.

Wir bei der Pro verstehen uns als aktiver Partner auf Augenhöhe, der die Transformation der Branche begleitet und mitgestaltet. Als führender Anbieter in der Bearbeitung biometrischer Risiken in Deutschland verfügen wir über ein Team aus 35 hochqualifizierten Leistungsprüfenden mit umfangreichem Erfahrungswissen. Dadurch unterstützen wir Erstversicherer flexibel und bedarfsgerecht – sei es durch eine umfassende Schadenbearbeitung oder durch gezielte medizinische und rechtliche Einschätzungen. Für Gesellschaften mit geringem Schadenaufkommen bieten wir vollständige Outsourcing-Lösungen an, während wir im Bedarfsfall mit qualifiziertem Personal im Rahmen der Arbeitnehmerüberlassung kurzfristig einspringen können.

Darüber hinaus beraten wir Versicherer strategisch und operativ bei der Optimierung ihrer Fachprozesse, der Steigerung der Qualität in der Schadenbearbeitung und der Einführung technischer Unterstützung. Dabei entwickeln wir eigene KI-Tools und digitale Systeme, die wir aktuell intern einsetzen, perspektivisch aber auch dem Markt zur Verfügung stellen werden.

Ich sehe einige übergreifende Themen, denen wir uns als Branche stellen sollten. Dazu zählen vor allem die Notwendigkeit, attraktive und flexible Arbeitsmodelle zu schaffen sowie gezielt in die Qualifizierung und Weiterentwicklung unserer Mitarbeitenden zu investieren – immer im Zusammenspiel mit einer offenen Haltung gegenüber neuen Technologien. Entscheidend ist dabei, die Belegschaft frühzeitig in Veränderungsprozesse einzubinden und eventuelle Vorbehalte gegenüber neuen Systemen sensibel aufzufangen und abzubauen.

Bei aller Dynamik in Richtung Digitalisierung darf der Mensch nicht aus dem Blick geraten. Kundenorientierung, persönliche Erreichbarkeit und nachvollziehbare Prüfprozesse bleiben für mich wesentliche Erfolgsfaktoren. Gleichzeitig stehen wir in der Leistungsprüfung vor neuen Herausforderungen – etwa durch steigende Antragszahlen aber auch neue Produkte/Produktvarianten.

Ein persönliches Anliegen ist mir der sogenannte Field-Service – ein Bereich, in dem ich selbst lange tätig war und dessen Mehrwert ich bis heute besonders in komplexeren Leistungsfällen als hoch relevant empfinde. Der Anspruch an Effizienz darf aus meiner Sicht nicht dazu führen, dass das persönliche Gespräch an Bedeutung verliert.

Als Partner auf Augenhöhe bringen wir ein stetig wachsendes Know-how und ein breites Serviceportfolio in die Zusammenarbeit mit Versicherern ein. Ich wünsche mir, dass dieser Beitrag als Chance wahrgenommen wird – um gemeinsam daran zu arbeiten, Qualität und Flexibilität in der Schadenbearbeitung nachhaltig abzusichern.

To speak to the Pro Global team please feel free to reach out to us at:

Name: Roman Hannig

Job title: Head of Client Engagement

To contact our PR team directly please use the link below

London, UK – 2nd of July 2025: Pro Global (“Pro”), a trusted advisor to the specialist insurance market, today announced the launch of Audit-Tech: Vendor Assurance, a next-generation service that empowers insurers to confidently manage third-party risk through a practitioner-led, technology-enhanced approach.

Developed in response to growing demand from insurers for smarter, scalable and compliance-focused oversight of third party vendors in an increasingly complex vendor landscape. Pro’s Audit-Tech solution meets that challenge – combining intelligent automation, practitioner insight, and seamless integration with clients’ governance frameworks.

The service delivers a full-lifecycle solution for vendor audits and assurance, using AI-enabled tools to streamline risk scoring, automate documentation workflows and provide real-time analytics – underpinned by expert audit teams who tailor each programme to client-specific risk appetites and regulatory obligations.

Audit-Tech: Vendor Assurance Highlights:

Pervin Sivanathan, Group Head of Audit and Advisory at Pro Global, said: “Third party risk management is a key topic for global re/insurers, and in launching our Audit-Tech Vendor Assurance platform we are directly responding to market demand for compliance and confidence. By combining intelligent automation with practitioner-led expertise, we’re helping insurers move away from fragmented, manual processes and towards a more robust, scalable and strategic approach to third-party assurance. From risk-tiered audit strategies to ongoing monitoring, we help clients stay ahead of emerging risks and increasing regulatory scrutiny.”

Kristy Lovegrove, Group Head of Technology at Pro Global, said: “This is a powerful blend of smart technology and human expertise. Our AI-enabled platform surfaces emerging risks faster and with greater precision, while our portal gives clients a single source of truth for real-time dashboards, document workflows and progress tracking. It’s a leap forward in how the insurance industry can manage and mitigate vendor risk at scale.”

To contact our PR team directly please use the link below

To speak to the Pro Global team please feel free to reach out to us at:

To contact our PR team directly please use the link below

This article is shared with the kind permission of AIRROC.

As we move into the second half of 2025 and start casting a cautious eye toward 2026, the legacy and run-off re/insurance market continues to play an increasingly pivotal role in the broader insurance ecosystem. No longer viewed as a quiet corner of the industry, the legacy sector is now a dynamic space where balance sheet optimisation, capital efficiency, and operational simplification are converging in sophisticated and often innovative ways.

What we’re witnessing is a maturing market, characterised by orderly deal flow, deepening specialisation, and a growing recognition of the long-term value legacy solutions can offer, beyond distressed scenarios, but as a proactive component of corporate strategy.

A Solid Start to 2025

H1 2025 saw a steady stream of legacy transactions across Europe and the UK, underscoring the enduring demand for liability portfolio offloading and finality solutions. DARAGs acquisition of wefox Insurance AG’s run-off portfolio in Germany, Italy and Switzerland was one of several notable transactions.

This deal followed wefox’s strategic divestment of non-core operations and marked a significant restructuring milestone for the insurer, illustrating how legacy transactions can act as enablers of broader business transformation.

Likewise, DARAG’s UK-focused loss portfolio transfer with Soteria Insurance Ltd., which involves commercial lines policies in run-off, is emblematic of a healthy legacy market in the UK. Notably, this transaction is structured with a subsequent Part VII transfer, reinforcing the importance of regulatory foresight and robust planning in legacy deals.

Across both deals, we see not just the removal of liabilities, but also the freeing up of capital, resources, and strategic bandwidth. It’s not about winding down, it’s about moving forward.

Crossroads of Innovation and Complexity

While traditional run-off and loss portfolio transfer (LPT) deals continue to underpin the market, there’s an increasingly innovative edge forming at the intersection of legacy and alternative capital. Recent ILS-based legacy transactions in Bermuda are quietly reshaping perceptions of what legacy can mean in the capital markets context.

By offering finality for trapped capital in property ILS portfolios, these deals are unlocking new types of value for investors and reinsurers alike. However, adoption remains niche for now. Appetite for these structures is still constrained by long investment horizons and the inherently forensic nature of legacy transactions, which makes it difficult to match them to the return expectations of most ILS investors.

Nevertheless, the convergence of ILS and legacy is a trend worth watching. It suggests that market participants are willing to explore increasingly bespoke solutions to address long-tail risks.

An Orderly Market with Headroom to Grow

Looking ahead to H2 2025 and into early 2026, we expect continued activity in Europe and the UK, particularly among mid-sized carriers looking to divest non-core portfolios or streamline historical liabilities. The market has matured considerably over the past five years, and today’s transactions are characterised by pragmatism, commercial logic, and regulatory rigour.

That said, we should not mistake a stable outlook for a simple one. Every run-off transaction presents its own complexities, whether it’s cross-border regulatory challenges, data quality issues, or legacy systems that require unpicking. The need for experienced counterparties and advisors remains paramount, particularly as deal sizes become more substantial and execution timelines more compressed.

In parallel, the growing focus on ESG and corporate governance is prompting insurers to look more closely at how they manage their legacy liabilities from a capital or solvency perspective as well as a reputational and operational standpoint as well.

What to Expect in 2026

Looking ahead, the outlook for 2026 remains fundamentally positive. We anticipate that legacy will continue to be used as a proactive strategic tool rather than just a back-end fix. There are three broad areas to watch:

Ultimately, the legacy market has evolved far beyond its historical image as a niche clean-up service. It is now an essential tool in the modern insurer’s toolkit, whether the goal is to restructure, exit, simplify, or redeploy.

As long as carriers continue to manage long-tall exposures and face capital efficiency demands, the need for high-quality, strategic legacy solutions will remain constant. The challenge for the market will be to continue evolving at the same pace as the problems it aims to solve.

To speak to the Pro Global team please feel free to reach out to us at:

Name: Richard Emmett

Job title: Head of Insurance Services

To contact our PR team directly please use the link below

It’s a misconception that continues to create risk across the insurance value chain: the idea that because surplus lines insurers doing business in the US (wherever domiciled) are “non-admitted,” they are also somehow “non-regulated.” This is a “non-truth” and recent regulatory developments in Florida provide a stark reminder of what’s at stake.

Florida, like other states, maintains strict statutory obligations for surplus lines insurers and agents, including timely and accurate premium reporting. Non-compliance can lead to serious consequences, up to and including removal from the state’s eligibility list for surplus lines transactions. Market participants will be aware of a recent notice involving several carriers referred to the Florida Office of Insurance Regulation due to reporting failures.

Where Things Can Go Wrong: Pitfalls of Poor Reporting

Surplus lines insurers must take proactive steps to prevent data-related shortcomings and incomplete or inaccessible information from the surplus lines insurer’s MGA partner’s creating regulatory risk.

This highlights a critical yet sometimes overlooked component of surplus lines compliance: carrier reliance on the operational integrity of their MGAs. When oversight is weak or incomplete, reporting slips. When reporting slips, compliance suffers, and regulators take notice.

Pro Global’s audit and advisory work has uncovered the same pattern: MGAs underestimating the importance of data quality and compliance reporting. Many are operating under outdated assumptions about the regulatory leeway in the surplus lines space. But while surplus lines carriers are not subject to the same rate and form filing requirements as admitted insurers, they are absolutely subject to financial, tax, and operational reporting obligations. And increasingly, regulators are holding carriers – and, by extension, their MGA partners – to account.

What “Good” Looks Like

Best-in-class MGA oversight is not just about contractual compliance. It’s about establishing clear governance structures, aligning data standards, conducting regular audits, and creating feedback loops that catch issues before they escalate.

If you’re a carrier working with MGAs in the surplus lines market, ask yourself:

Do we have visibility into the quality and timeliness of our MGA reporting

Are we auditing data submissions for accuracy and consistency?

Have we educated our MGAs about their regulatory obligations in each state they operate

Do our contracts and controls allow us to intervene when reporting standards slip?

A Shared Responsibility

Ultimately, the reputation of the surplus lines market depends on all players understanding and fulfilling their roles. Regulators are sharpening their focus, and the days of flying under the radar are behind us.

The audit experts at Pro Global here in the US and indeed globally are working with carriers and MGAs alike to ensure that their compliance infrastructure can stand up to increased scrutiny. Whether through advisory support, audit programs, or data reconciliation, the goal is the same: robust, reliable operations that protect carrier eligibility, agent trust, and market reputation.

Further reading: How Louisiana’s House Bill 672 Is Reshaping the MGA and TPA Landscape

Find out more about how we can support you: https://pro-global.com/specialists/robert-sherman/

Name: Robert Sherman

Job title: US Head of Audit & Advisory

To speak to the Pro Global team please feel free to reach out to us at:

To contact our PR team directly please use the link below

As the MGA market continues to evolve and expand globally, Danny Maleary, CEO of Pro MGA Global Solutions, shared his perspective on the sector’s trajectory, the drivers behind its resilience, and the mindset needed for MGA success, with the Insurance Insider’s Behind the Headlines podcast.

With nearly four decades in the insurance industry, Danny has seen the MGA model transform from a niche concept to a central pillar of insurance innovation and distribution. What began as an idea in earlier iterations of incubator businesses came to life with the founding of Pro MGA Global Solutions in 2016, launched online in 2017 with a clear vision: to create a global framework for underwriting talent and insurance entrepreneurs.

“The MGA model is not just a boom or a phase, it’s a consistent, increasing presence driven by insurers, reinsurers, investors, and distributors who are actively seeking to handle insurance differently,” Danny explains.

One of the most frequent misconceptions about launching an MGA is that it’s simply a more agile version of working inside a large insurer. But, as Danny notes, being an MGA principal means being a regulated individual, and that requires a fundamental mindset shift.

“There’s a huge difference between being employed in a corporate setting and being responsible for every aspect of your own regulated entity. From governance to making sure there’s milk in the fridge, you’re accountable. It’s a steep learning curve, and not everyone is suited to it.”

While capacity is a common talking point, Danny stresses that it’s not just about securing capacity; it’s about aligning with the right capacity partner. “The biggest challenge isn’t just finding capacity, it’s finding the right partner whose vision aligns with yours. That alignment is what ultimately determines success or failure.”

Danny also emphasises that the value of MGAs lies in their entrepreneurial people, many of whom bring new energy, product innovation, and a desire to deliver one-to-one value to customers that corporates sometimes struggle to replicate.

Pro MGA Global Solutions now sees 10 to 15 MGA approaches per month, a sharp increase from the 5 to 10 seen in prior years. That growth is global, not just limited to London or the UK, and driven by individuals seeking greater autonomy and product ownership.

“What’s interesting is seeing big corporate brands now embracing the MGA model, something that would have been unthinkable a decade ago,” Danny says.

Gone are the days when MGAs were seen as stop-gaps or quick exits. The perception is shifting. While some still imagine MGAs as launchpads to a capital event or exit strategy, Danny cautions against oversimplifying.

“There’s a snowball effect happening. We’re seeing more MGAs launched with a long-term strategy and with a mature understanding of what it means to build and run a regulated insurance business.”

Many thanks to the Insurance Insider host Sam Casey for this engaging discussion. Listen to the full podcast here.

Pro MGA Global Solutions continues to support this new wave of MGA leaders, helping them understand the responsibilities of running an MGA, connecting them with aligned capacity partners, and building frameworks for long-term success.

For more insight into Pro MGA’s work or to explore launching your own MGA, visit: Pro MGA Global Solutions

Name: Danny Maleary

Job title: CEO, Pro MGA Global Solutions

To speak to the Pro Global team please feel free to reach out to us at:

To contact our PR team directly please use the link below

Underwriting has never stood still. It’s a discipline constantly shaped by shifting market dynamics. But today, that evolution is being tested from a resourcing perspective. With talent in short supply and demands growing more complex, underwriting teams are under pressure to do more, faster, and with fewer resources. This isn’t simply a staffing issue. It is a broader challenge around how we reshape underwriting operations to stay resilient and responsive, without losing the depth, consistency, and expertise that high-quality underwriting demands.

This strain is being felt across the board. Traditional international insurers are competing to retain experienced underwriting professionals, while scale-up MGAs are vying for the same pool of entrepreneurial talent. The latter often offer flexibility and autonomy but can lack the mature support structures needed to help underwriters thrive. Both ends of the market are learning that without the right operational support, even the best talent can’t deliver their full potential.

Tuning into TUPE

One increasingly effective solution is to rethink how underwriting support functions are structured, starting with the people. TUPE (Transfer of Undertakings Protection of Employment) arrangements, often seen as dry legal processes, can in fact be strategic tools for protecting knowledge, enhancing team continuity, and ensuring a smooth operational transition when support services are outsourced or reshaped.

When underwriting assistants and support teams are transitioned under TUPE, their skills, systems understanding, and business knowledge stay within the organisation, even if their employer changes. More importantly, when the transition is handled with care – through transparent communication, structured change management, and training support – it boosts morale, sharpens role clarity, and strengthens operational resilience. This is true whether you’re managing global portfolios or scaling a specialty MGA.

This people-first approach contrasts sharply with traditional offshoring models, which often fall short in high-touch, specialist environments like underwriting. While offshoring might offer cost savings, it frequently introduces challenges such as time zone delays, poor service continuity, and limited sector expertise. These risks are amplified in underwriting, where responsiveness, judgement, and accuracy are critical.

More than admin support

Underwriters don’t just need admin support. They need informed, empowered teams who understand the nuances of the business, can anticipate bottlenecks, and actively support process improvement. Best practice models are now building support functions that are not just efficient, but embedded in the underwriting ecosystem.

That begins with consistency. Standardised operating procedures, tailored by line of business and shaped by input from frontline staff, are essential. Clear task ownership is equally important. Every task needs an accountable owner, so underwriters can focus on decisions rather than chasing actions or fixing duplication.

Upskilling also plays a major role. Training should be ongoing, adaptive, and tracked. This is particularly important in fast-moving MGA environments, where junior staff or regional teams may not have the benefit of sitting alongside experienced underwriters. Structured training builds confidence, quality, and cohesion across hybrid teams.

Collaboration, too, must be intentional. Whether in London, Liverpool or Luxembourg, support teams need to be connected through shared goals, aligned tools, and integrated communication channels. A truly collaborative culture turns support staff into strategic partners, not just process handlers.

Optimisation is not a one-off event. It demands continual refinement; understanding what’s working, identifying friction points, and adapting quickly. Root cause analysis, performance insight, and staff feedback all play a part. But the foundations for success are often laid at the outset, during moments of operational transition.

This is where TUPE can be especially powerful. When handled well, it creates the stability and continuity that enable real improvements in underwriting processes to take hold. In one case, Pro Global supported the TUPE transfer of 50 staff members from an outsourced service provider, where the team had been embedded within a major specialty re/insurer’s operations, , implementing risk mitigation strategies, conducting a thorough root cause analysis, and enhancing operation resilience and allowing the business to maintain high quality onshore service while benefitting from a more cost-effective approach.

These optimisation efforts led to improved operational efficiency, enabling the re/insurer to handle increased underwriting workloads, deliver higher levels of service and continue expanding its capabilities.

We’ve seen firsthand how a deliberate, strategically managed transfer and support model can transform underwriting capacity – delivering onshore quality, cost-efficiency, and scalable underwriting growth in equal measure. As the talent squeeze tightens, the winners we feel are those who invest in people-centric support today to underwrite their success tomorrow.

This article is shared with the kind permission of insurance Edge

Name: Shayne Caple

Job title: Head of Underwriting Services

To speak to the Pro Global team please feel free to reach out to us at:

To contact our PR team directly please use the link below

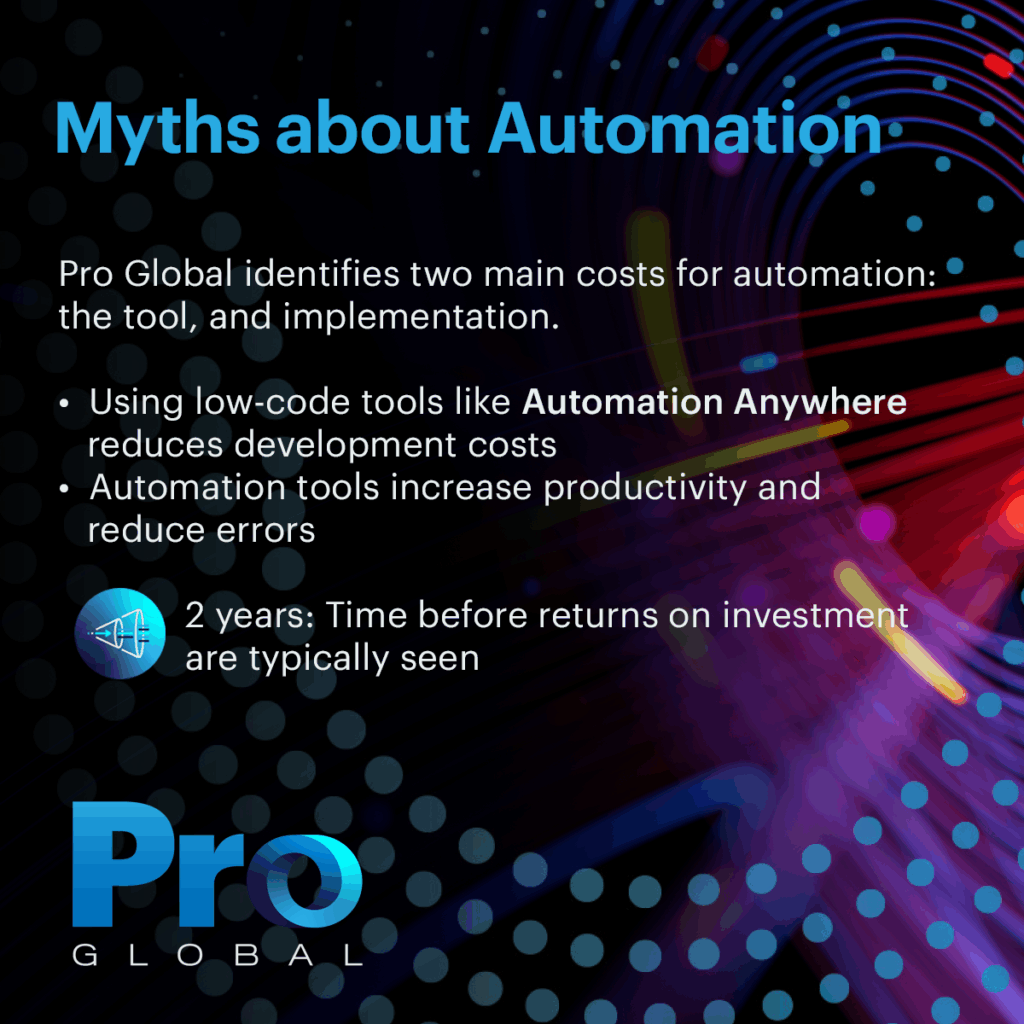

You might currently be debating whether to launch an automation process within your sector. It’s clear that automation is a hot topic, but something that’s not often discussed is the cost of implementation.

Many companies today assume they’re not good candidates for automation due to the upfront costs such projects entail. That’s why we’re taking this opportunity to explain what these initial costs actually involve.

At Pro Global, automation projects are viewed as having two main costs: the cost of the tool and the cost of implementation. Although these combined might initially seem high, a closer look often reveals that they’re more accessible than you might expect.

On the implementation side, it’s crucial to opt for leading low-code automation tool like Automation Anywhere®, which allow for faster development compared to others, thereby reducing development hours and consequently, project costs. Additionally, this tool (the most used by Pro Global) is intuitive and user-friendly.

Another key factor is selecting the right partner to lead the development. It’s essential that they have experience in insurance and reinsurance to avoid delays or misunderstandings during the project. Moreover, some partners offer the added value of training an internal staff member so they can later handle improvements themselves.

Lastly, we mustn’t forget about the tool itself. While it’s true that these usually have a fixed price in US dollars and require annual investment, we tend to overlook the fact that they operate 24/7, vastly expanding our productive capacity. When we crunch the numbers, it often becomes clear that automation delivers greater capacity at a more competitive cost.

From our experience, implementing these solutions also dramatically reduces errors in repetitive tasks that add no value to the organisation and in many cases, the returns can be seen in less than two years.

Therefore, if you or your organisation are thinking that automation is too expensive, Pro Global invites you to rethink that idea and get in touch with us to explore the feasibility of automating an already-identified process, or even to help identify which processes within your organisation could be automated.

Name: Aldo Alvarez

Job title: RPA Developer, Latin America

To speak to the Pro Global team please feel free to reach out to us at:

To contact our PR team directly please use the link below

Probablemente hoy estés debatiendo si lanzar un proceso de automatización dentro de tu sector. Es evidente que la automatización está en boca de todos, pero algo de lo que no se habla mucho es de los costos de implementación.

Hoy en día muchas empresas consideran que no son buenas candidatas para la automatización debido a los costos iniciales que estos proyectos implican. Por eso aprovechamos esta oportunidad para explicar en qué consisten realmente estos costos iniciales.

En Pro Global, los proyectos de automatización consideran dos costos principales: el costo de la herramienta y el costo de implementación. Aunque combinados puedan parecer altos al principio, un análisis más detallado suele revelar que son más accesibles de lo que esperas.

En cuanto a la implementación, es fundamental optar por una herramienta líder de automatización low-code como Automation Anywhere®, que permite un desarrollo más rápido en comparación con otras, reduciendo las horas de desarrollo y, por consiguiente, los costos del proyecto. Además, esta herramienta (la más usada por Pro Global) es intuitiva y fácil de usar.

Otro factor clave es seleccionar el Partner adecuado para liderar el desarrollo. Es esencial que tenga experiencia en seguros y reaseguros para evitar retrasos o malentendidos durante el proyecto. Además, algunos socios ofrecen el valor añadido de capacitar a un miembro interno del equipo para que luego pueda gestionar las mejoras por sí mismo.

Por último, no debemos olvidar la herramienta en sí. Aunque suelen tener un precio fijo en dólares y requieren una inversión anual, tendemos a pasar por alto que funcionan 24/7, expandiendo enormemente nuestra capacidad productiva. Al hacer números, a menudo queda claro que la automatización ofrece mayor capacidad a un costo más competitivo.

Según nuestra experiencia, implementar estas soluciones también reduce drásticamente los errores en tareas repetitivas que no aportan valor a la organización y, en muchos casos, el retorno se puede ver en menos de dos años.

Por ello, si tú o tu organización piensan que la automatización es demasiado costosa, Pro Global te invita a reconsiderar esa idea y contactarnos para explorar la viabilidad de automatizar un proceso ya identificado, o incluso para ayudarte a identificar qué procesos dentro de tu organización podrían automatizarse.

Name: Aldo Alvarez

Job title: RPA Developer, Latin America

To speak to the Pro Global team please feel free to reach out to us at:

To contact our PR team directly please use the link below