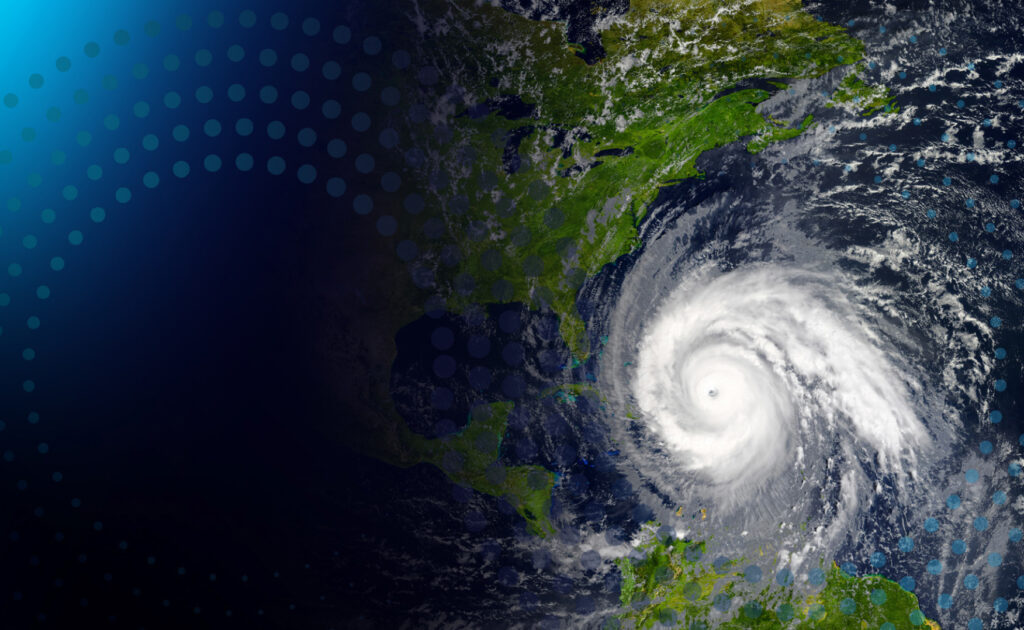

As the 2024 Atlantic hurricane season looms with forecasts predicting an above-average activity, insurance companies must brace themselves for the impending surge in catastrophe claims. With sea surface temperatures at record highs and a weakening El Niño reducing wind shear, the stage is set for potentially devastating storms. In such times, the efficiency and effectiveness of claims processing become paramount in restoring normalcy to affected policyholders.

Global insured natural-catastrophe losses in 2023 surpassed $100bn for the fourth year in a row, according to Swiss Re. The carrier said the main driver of last year’s $108bn in losses was the frequency of events, with severe convective storms (SCS) accounting for a record $64bn in losses during the year.

The North Atlantic Hurricane season officially begins on June 1, 2024, and ends on November 30, 2024.

Here are three key tips to help insurers prepare now, to prevent claims delays when it matters most for policyholders.

1. Plan for Surge Resources

First and foremost, insurers need robust surge resource plans tailored to handle the expected influx of claims. Putting policyholders front and center means ensuring fast, efficient, and fair payment of claims as soon as possible after a catastrophe strikes. Questions to ask your operational team include:

- Do you have a designated loss adjuster panel in place?

- Is there a fully staffed first review of loss mailbox ready to respond if inundated?

- Have you established a surge claims team specifically for hurricane claims while maintaining business as usual?

2. Streamline Claims Processing

Efficient claims processing hinges on streamlined workflows and effective collaboration, especially with reinsurers. It’s crucial to have the correct approval protocols in place to ensure smooth authorisation and payment of large catastrophe claims. Moreover, anticipating and preparing for business interruption and related liability claims in the medium-term aftermath of a storm is imperative.

3. Leverage Expertise and Experience

At Pro Global, our team boasts extensive experience in supporting insurance businesses during surges in claims, including the aftermath of Hurricanes Irma and Maria in 2017. We understand the criticality of accuracy and efficiency in the loss adjusting and claims handling process. By identifying common challenges faced by our clients, we develop best-in-class solutions aligned with the demands of catastrophic hurricanes.

4. Act Now

Don’t wait for the storm to hit—act now to put resources in place. Getting in touch with claims experts like those at Pro Global can help insurers proactively prepare for the challenges ahead. By leveraging our expertise and tailored solutions, insurers can navigate the complexities of an above-average hurricane season with confidence.

Efficient claims servicing during a surge in catastrophe claims can make or break an insurer’s reputation. Proactive planning, streamlined processes, and expert support are essential. By prioritising policyholder needs, optimising workflows, and leveraging industry experience, insurers can ensure they are ready to fulfill their commitment to customers in times of crisis, where the promise of insurance matters most.

Get in touch with the claims experts at Pro Global today to fortify your claims servicing capabilities and prepare for the challenges ahead.

Meet our expert

Name: Guillermo Ogan

Job title: Claims Manager (LatAm)

Get in touch

To speak to the Pro Global team please feel free to reach out to us at:

Lysander PR

To contact our PR team directly please use the link below

View Previous

View Previous