Latin America is emerging as a global hotspot for insurance innovation, with automation playing a central role in reshaping the efficiency and interconnectivity of the market. According to Mapfre’s overview of the insurtech ecosystem in Latin America, the region is experiencing rapid digital transformation, with automation becoming a key driver of efficiency and growth. Insurers – both domestic and international – are racing to deploy automation to streamline processes, reduce costs, and enhance customer experiences.

As a result, here at Pro Insurance Solutions, we are witnessing a surge in demand for high quality, value-add automation expertise as insurers prepare for 2025 and beyond.

Catalyst for Change

Economically and socially, the conditions are ripe for strong growth in re/insurer adoption of automation in LatIn America – they are responding to shifts in society and the economy. Rapid digitalisation, a growing middle class, and increasing insurance penetration meeting customer expectations for streamlined digital experiences are driving the need for agile, technology-driven underwriting and claims management. As a result, automation is being integrated across the entire insurance lifecycle – from policy issuance and underwriting to claims handling and fraud detection.

A prime example of automation’s impact can be seen in Paraguay, where a leading insurer successfully streamlined its underwriting process through automation, reducing processing times from days to minutes. This transformation not only improved operational efficiency but also enhanced the customer journey, demonstrating the tangible benefits of embracing digital solutions.

A flight to quality

Latin America’s insurtech sector is thriving, with startups and established insurers alike investing heavily in AI-driven analytics, machine learning, and robotic process automation (RPA). The region has become a testing ground for next-generation insurance models, with countries like Brazil, Mexico, and Colombia leading the charge. From AI-powered chatbots for customer service to blockchain-based claims processing, Latin America is demonstrating how automation can revolutionise the insurance industry.

One key driver of this innovation is the regulatory landscape. Governments across the region are embracing digital transformation, fostering environments that encourage insurtech adoption. This proactive approach is enabling insurers to experiment with new models, improve compliance, and expand access to previously underserved markets.

How Pro Global is Supporting the Digital Shift

At Pro Global, we understand the unique challenges and opportunities presented by the Latin American insurance market. Through Pro Global Digital Services, we provide insurers with cutting-edge automation solutions tailored to their specific needs. Our expertise in process optimisation, AI-driven underwriting, and digital claims management allows our partners to enhance efficiency, reduce operational costs, and deliver superior customer experiences.

Beyond technology, insurers are looking for trusted partners with a track record of success. In a rapidly evolving market, Pro Global’s position as a global leader in compliant and scalable automation solutions provides a crucial advantage. We bring:

As we move into 2025, the demand for automation in Latin America will only intensify. Insurers that fail to adapt risk being left behind in an increasingly competitive landscape.

Get in Touch

Pro Global is at the forefront of this transformation. Whether you’re looking to modernise your underwriting processes or implement AI-driven claims automation, we can help. Contact us today to learn how our digital solutions can future-proof your operations and position you for success in the evolving Latin American insurance market.

To speak to the Pro Global team please feel free to reach out to us at:

Name: Martin Smith

Job title: Director of Latin America

To contact our PR team directly please use the link below

Marina Belardo, Head of Operations and People, brings a unique mindset to Pro LatAm, ensuring operations are not just about processes, technology and service-levels, but about the people who drive them.

As Head of Operations and People at Pro LatAm, Marina Belardo sits at the intersection of two critical pillars of business – strategic operations and human capital. Her journey with Pro Global began nearly three years ago when she joined as Head of People, a role that expanded in scope last year to include operations. With a background in consultancy and operations management, Marina brings a unique dual lens to leadership, one that fuses performance-driven systems with a deep understanding of people.

Before joining Pro, Marina spent seven years in consultancy, managing a range of transformation projects. That experience laid the foundation for her operational mindset but also sharpened her awareness of the human element in business success. “In consultancy, you’re there to deliver a project – but it’s the people who make it happen. Improving service quality isn’t just about fixing processes; it’s about engaging the people who run them,” she explains.

New challenges for a maturing market

This belief has guided her approach at Pro LatAm, especially during a period of significant market and organisational change. In the last 18 months, the Latin American insurance sector has been navigating new challenges. As inflation began to drop after a long period of economic instability, insurers could no longer rely on financial instruments to bolster results. The new focus has been to do more with less, essentially needing to become leaner, more agile, and more efficient.

For Pro LatAm, this pivot meant doubling down on service quality and employee engagement. “In Argentina, we were facing challenges with the level of service being delivered. The first step was to re-engage our teams. We worked closely with managers to instill the right mindset and align our people with shared values,” Marina says. This people-first approach led to measurable improvements in service delivery and client satisfaction.

But Marina’s transformation plan didn’t stop there. Alongside cultural shifts, Pro LatAm has undergone a wide-reaching evolution in its use of technology and process optimisation. By focusing on enhancing both tools and talent, the company is helping client organisations not only stay profitable but also thrive under new operational demands.

Focus Fuels Success

What sets Pro Global apart, according to Marina, is its singular focus on insurance services. “Unlike our competitors, we’re not diluted across multiple markets. We’re specialists – and that makes a difference.” Pro also brings a distinctly English model to its work in Latin America, which encompasses a results-oriented, well structured, and strategic approach. “We take a 360-degree view of our clients’ operations,” she adds. “That means we can identify and improve every touchpoint – from internal workflows to end-client delivery.”

Under Marina’s leadership, Pro LatAm has embraced this full-spectrum approach with momentum and purpose. Her belief in aligning operations with people strategy is more than just a management philosophy, she believes it’s a blueprint for long-term success.

As the insurance sector continues to evolve, Marina Belardo’s blend of operational rigor and human insight ensures that Pro LatAm remains a catalyst for meaningful change in the industry.

To speak to the Pro Global team please feel free to reach out to us at:

Name: Marina Belardo

Job title: Head of Operations and People

To contact our PR team directly please use the link below

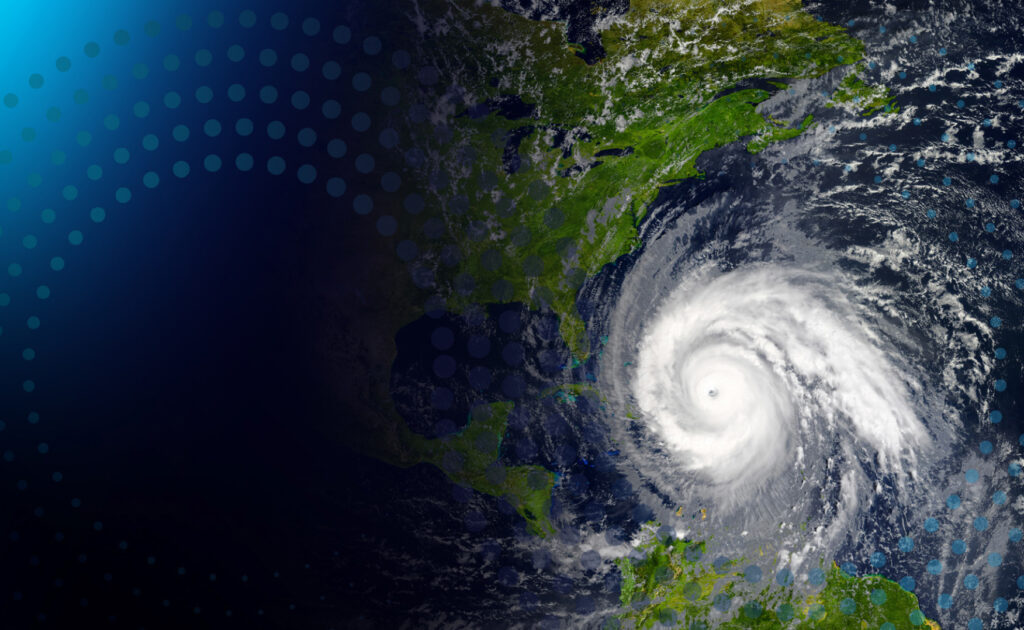

Con temperaturas de la superficie de los océanos en niveles récord y un debilitamiento de El Niño que reduce la velocidad del viento, el escenario se estaría preparando para tormentas potencialmente devastadoras. En esos momentos, la eficiencia en el procesamiento de siniestros, se vuelven primordial para brindar un excelente servicio a los asegurados afectados.

Las pérdidas aseguradas mundiales por catástrofes naturales en 2023, superaron los US$ 100.000 millones por cuarto año consecutivo, según Swiss Re. El citado Reasegurador, también indicó que el principal factor de las pérdidas de US$ 108 mil millones del año pasado, fue la frecuencia de los eventos, mientras que las tormentas convectivas severas (SCS), representaron un récord de US$ 64 mil millones de pérdidas durante el año.

La temporada de huracanes del Atlántico Norte, comienza oficialmente el 1 de junio de 2024 y finaliza el 30 de noviembre de 2024.

A continuación, detallamos tres consejos claves para ayudar a las aseguradoras a prepararse ahora y evitar retrasos en la gestión de los siniestros:

En primer lugar, las aseguradoras necesitarán delinear un plan de adecuación de recursos humanos y tecnológicos para poder afrontar el incremento estacional de los siniestros. Poner a los asegurados en primer plano, significa garantizar un pago rápido, eficiente y justo de las reclamaciones una vez ocurrida una catástrofe natural. Las preguntas que cada aseguradora debe hacerle a su equipo operativo incluyen:

El procesamiento eficiente de siniestros catastróficos, depende de flujos de trabajo optimizados y de una colaboración eficaz, especialmente con las Reaseguradoras. Es crucial contar con los protocolos de gestión de siniestros y aprobación de pagos correctos para garantizar el rápido pago de montos significantes. Además, es imperativo anticipar y prepararse para los reclamos de Business Interruption que también impactarán a corto y mediano plazo, posteriores al evento catastrófico.

En Pro Global, nuestro equipo cuenta con una amplia experiencia en brindar soporte a las Aseguradoras y Reaseguradoras durante los aumentos repentinos de reclamaciones, tal como sucedió luego de los huracanes Irma y María en 2017. Entendemos la importancia crítica de la precisión y la eficiencia en el proceso de ajuste de pérdidas y manejo de siniestros. Al identificar los desafíos comunes que enfrentan nuestros clientes, desarrollamos las mejores soluciones alineadas con las demandas de huracanes y otros eventos catastróficos.

No espere a que llegue la tormenta; actúe ahora para organizar sus recursos humanos y tecnológicos. Ponerse en contacto con expertos en reclamaciones como los de Pro Global, puede ayudar a las Aseguradoras y Reaseguradoras a prepararse de forma pro-activa para los desafíos que se avecinan. Al aprovechar nuestra experiencia y soluciones personalizadas, las Aseguradoras y Reaseguradoras, pueden afrontar con confianza las complejidades de una potencial temporada de huracanes superior al promedio.

La prestación eficiente de servicios de siniestros durante un aumento de reclamaciones por eventos catastróficos, puede mejorar o empeorar la reputación de una Aseguradora. La planificación proactiva, los procesos optimizados y el apoyo de expertos son esenciales. Al priorizar las necesidades de los asegurados, optimizar los flujos de trabajo y aprovechar la experiencia de la industria, las aseguradoras y reaseguradoras podrán confiar en que están preparadas para cumplir su compromiso con los clientes en tiempos de crisis, cuando se demuestra el valor de estar asegurado.

Name: Guillermo Ogan

Job title: Claims Manager (LatAm)

To speak to the Pro Global team please feel free to reach out to us at:

To contact our PR team directly please use the link below